1. Group Company Equity Structure Design

To protect the legal rights of co-founders and ensure the legal and compliant interests of all shareholders, the equity structure should be designed based on the core values of the shareholders. While safeguarding the rights of the original shareholders, it is crucial to reserve a reasonable portion of equity for future financing and talent acquisition, ensuring that the equity design of Reessen Times is scientifically sound and sustainable.

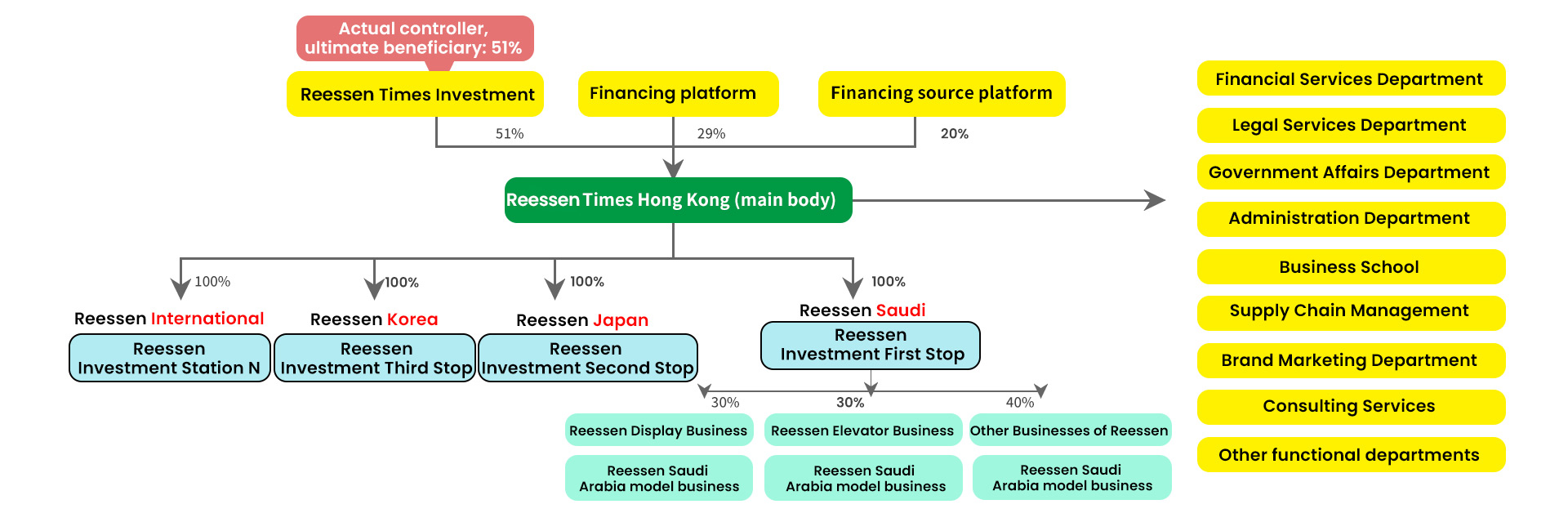

Reessen Times Group Equity Structure Reference

When designing the equity structure of the group company, several key points and core elements must be carefully reviewed. The design must maintain both rationality and scientific accuracy to protect shareholder interests. Additionally, a clear and explicit mechanism for shareholder entry and exit must be established to ensure that future changes in shareholder structure or profit distribution do not create bottlenecks in the company's development. It is essential to leverage collective wisdom and resources to ensure that the top-level design is as rational as possible. Successful cooperation is built on trust, and sustainable growth is guaranteed by rules and rationality.

2. Investment Company Equity Structure Design

"Together, for a lifetime, creating miracles." This bond is both a fate and a trust that unites us through time and space, driven by dreams and forged by trust. Reessen Times is an investment company, but more importantly, it is a community of wisdom and dreams. Everyone in Reessen Investment Company is indispensable and unique, and is the key force to ensure the success of this business.

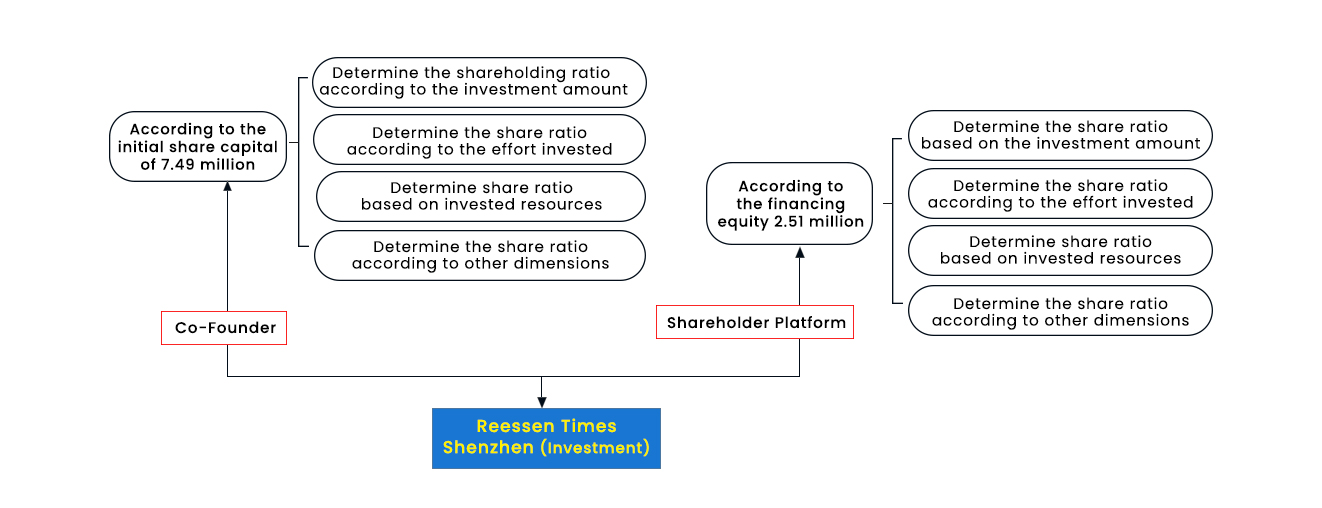

The equity structure of Reessen Investment Company is a comprehensive evaluation from multiple dimensions, mainly focusing on the investment of actual start-up funds, and the equity ratio is determined according to the actual investment amount.

Reessen Investment Company Equity Structure Reference